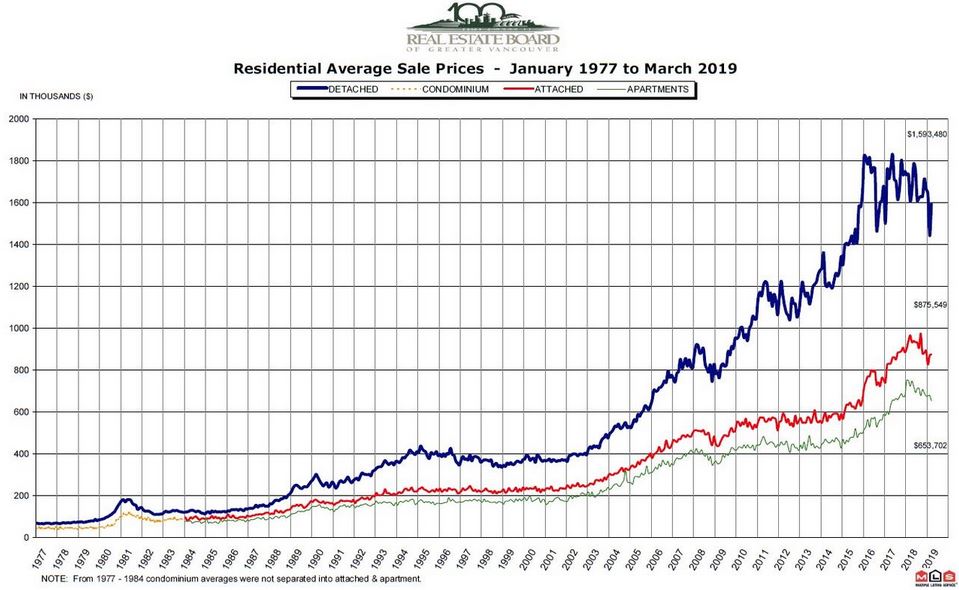

The collapse of Vancouver‘s housing market has become worldwide news, with total sales plummeting 46% over the past year, dropping to a level not seen since 1986.

The real estate industry is a key economic driver in British Columbia. In 2018, 24,619 homes changed ownership in the Board’s area, generating $1.7 billion in economic spin-off activity and an estimated 11,720 jobs. The total dollar value of residential sales in Greater Vancouver totalled $26 billion in 2018.

According to the Real Estate Board of Greater Vancouver (REBGV), residential home sales in the region totalled 1,727 in March 2019, a 31.4 per cent decrease from the 2,517 sales recorded in March 2018, and a 16.4 per cent increase from the 1,484 homes sold in February 2019. Last month’s sales were 46.3 per cent below the 10-year March sales average and was the lowest total for the month since 1986.

“Housing demand today isn’t aligning with our growing economy and low unemployment rates. The market trends we’re seeing are largely policy induced,” Ashley Smith, REBGV president said. “For three years, governments at all levels have imposed new taxes and borrowing requirements on to the housing market. What policymakers are failing to recognize is that demand-side measures don’t eliminate demand, they sideline potential home buyers in the short term. That demand is ultimately satisfied down the line because shelter needs don’t go away. Using public policy to delay local demand in the housing market just feeds disruptive cycles that have been so well-documented in our region.”

The BC Real Estate Association (BCREA) has recently reported numbers that show the slowdown in Vancouver’s market is spreading to other parts of the province. BCREA chief economist Cameron Muir said in a statement: “B.C. home sales continue to be adversely impacted by federal mortgage policy. The erosion of affordability caused by the B-20 stress test has created near recession-level housing demand despite the province boasting the lowest unemployment rates in a decade. The sharp erosion of affordability caused by the B-20 stress test is now creating pent-up demand, as many would-be home buyers are forced to wait on the sidelines. Unfortunately, new home construction is slowing as well, which will likely lead to another housing supply crunch down the road.”

However, many investors recognize that, for many years, the housing prices in the most populous city of Canada’s British Columbia had been manipulated by Chinese tycoon “hot money” flooding the market. Following the Chinese government’s crackdown on capital flight, the reckless buying is now quickly turning to panic selling.

According to data released by the Canadian Real Estate Association, the benchmark price for a property in Greater Vancouver is down 7.7% over the past year, to $1.011 million. The biggest discounts are coming from the top end of the real estate market and houses that have been listed for more than $1 million.

In Twitter, the so-called “price discovery hecklers” are carefully documenting Vancouver homes that are listed far below their last sold or assessed price or have been sold for far below their asking price, demonstrating the full extent of the city’s housing price appreciation:

TEXTBOOK GREATER FOOL CUTS ASKING PRICE $1M IN ONE SHOT ($2.6M TOTAL TO DATE), HAS $2M MORE TO GO, AND WILL LOSE +$1.75M

1575 29th Ave W, Shaughnessy, West Side #Vanre

Before I start… an initial ask of $7.6M on this property and the realtor can’t put up pictures that don’t pic.twitter.com/KcxvQe4FOM

— Vancouver Real Estate Flip Flops (@VanREflipflops) April 11, 2019

Image: Vancouver, Canada, Coal Harbor / ArtTower