Those who have already opened a Help to Buy ISA (or will do so before 30 November 2019) will be able to continue saving into their account until November 2029.

If you are saving to buy your first home, save money into a Help to Buy: ISA and the Government will boost your savings by 25%. So, for every £200 you save, receive a government bonus of £50. The maximum government bonus you can receive is £3,000.

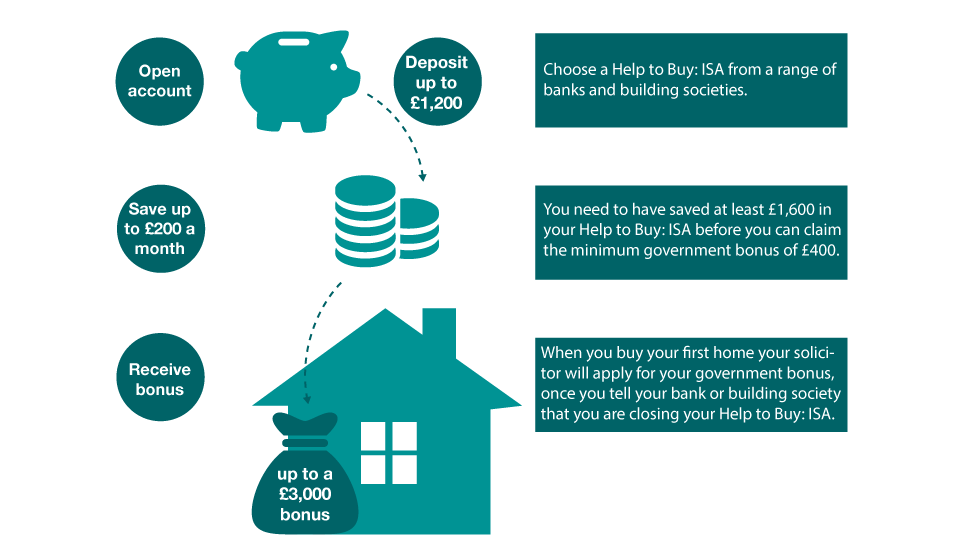

How the scheme works

Open: the Help to Buy: ISA is available from a range of banks, building societies and credit unions.

The accounts are available to each first time buyer, not each household. This means that if you are planning to buy with your partner, for example, you could receive a government bonus of up to £6,000 towards your first home.

Save: save up to £200 a month into your Help to Buy: ISA. To kickstart your account, in your first month, you can deposit a lump sum of up to £1,200.

The minimum government bonus is ¬£400, meaning that you need to have saved at least ¬£1,600 into your Help to Buy: ISA before you can claim your bonus. The maximum government bonus you can receive is ¬£3,000 ‚Äď to receive that, you need to have saved ¬£12,000.

Receive bonus: when you are close to buying your first home, you will need to instruct your solicitor or conveyancer to apply for your government bonus. Once they receive the government bonus, it will be added to the money you are putting towards your first home. The bonus must be included with the funds consolidated at the completion of the property transaction. The bonus cannot be used for the deposit due at the exchange of contracts, to pay for solicitor’s, estate agent’s fees or any other indirect costs associated with buying a home.

ISA calculator

Who is eligible

To qualify for the government bonus, the property you are buying must:

- be in the UK

- have a purchase price of up to £250,000 (or up to £450,000 in London)

- be the only home you will own

- be where you intend on living

- be purchased with a mortgage

You can use the Help to Buy: ISA with other government schemes, including the Help to Buy: Equity Loan scheme and Shared Ownership.

Visit Own your home for information on more government schemes.

Providers in the scheme

You can apply for your Help to Buy: ISA through one of these banks, building societies and credit unions either online, by telephone or in a branch unless otherwise stated:

- Aldermore

- Bank of Scotland

- Barclays

- Buckinghamshire Building Society

- Chelsea Building Society

- Chorley Building Society

- Clydesdale Bank

- Cumberland Building Society

- Darlington Building Society

- Halifax

- HSBC

- Lloyds

- Monmouthshire Building Society

- Nationwide

- NatWest

- Penrith Building Society

- Progressive Building Society

- Newcastle Building Society

- Nottingham Building Society

- Santander

- Tipton & Coseley

- Ulster Bank

- Vernon Building Society

- Virgin Money

- West Bromwich Building Society

- Yorkshire Bank

- Yorkshire Building Society

Image: Steve Watts